I may earn a commission from affiliate partner links featured here on my site. Such commissions allow me to maintain and improve this site. Read full Disclosure.

The digital finance world is easier to navigate than you think, especially for transferring funds. As tech in finance grows, secure, easy money management is for all. If you use Netspend and Cash App, you might want to move money between them. You can’t send money directly from Netspend to Cash App, but there’s a flexible workaround.

Paying a friend back, managing budgets, or shifting your own funds requires knowing this transfer trick. Let’s clear up how to send money from Netspend to Cash App. We’ll ensure your money moves safely and smoothly.

Contents

- 1 Understanding Netspend and Its Compatibility with Cash App

- 2 Setting the Stage for a Transfer: Preparing Your Accounts

- 3 How to Send Money from Netspend to Cash App Indirectly

- 4 Analyzing the Costs: Fees and Limits for Transfers

- 5 Navigating Troubleshooting for Common Transfer Problems

- 6 Managing Your Money Wisely: Tips and Best Practices

- 7 Conclusion

- 8 FAQ

- 8.1 Can I directly transfer funds from Netspend to Cash App?

- 8.2 What is Netspend and how does it work with Cash App?

- 8.3 How do I prepare my Netspend and Cash App accounts for a money transfer?

- 8.4 What are the steps for transferring money from Netspend to Cash App through PayPal?

- 8.5 Are there any fees for transferring money from Netspend to Cash App?

- 8.6 What could cause a transfer from Netspend to Cash App to fail?

- 8.7 How can I resolve issues during the transfer process between Netspend and Cash App?

- 8.8 What are some tips for managing money effectively when using Netspend and Cash App?

Key Takeaways

- Understand the indirect process required to transfer money from Netspend to Cash App.

- Learn the necessary steps to link your Netspend account to Cash App through an intermediary.

- Discover the importance of secure transactions in the transfer process.

- Recognize the benefits of integrating Netspend and Cash App in your money management routine.

- Gain knowledge about the workarounds and specifics to manage your finances across different platforms.

Understanding Netspend and Its Compatibility with Cash App

In today’s world, digital financial services are key. Knowing how Netspend prepaid cards and Cash App work together is vital. Netspend, a leading provider of alternative banking solutions, works well with Cash App. This offers users great convenience in handling their money.

What is Netspend?

Netspend has been a pioneer in financial services for those without traditional banking. It focuses on personalized money management. Netspend’s prepaid cards act like a debit card, making it easy to keep and use money.

Advantages of Using Netspend with Cash App

Using Netspend and Cash App together brings lots of flexibility. You can’t directly deposit from a Netspend card to Cash App. But you can transfer funds through another service. This is key for easy money management.

The Significance of Account Information Sharing and Linking

Netspend and Cash App require sharing important account info. This includes account numbers and routing numbers. It’s crucial for safely moving money between different digital wallets and services.

Linking Netspend and Cash App is based on secure information sharing. Here is a table that explains what info is needed to link accounts and move money.

| Information Required | Purpose |

|---|---|

| Netspend Account Number | Identifying your unique Netspend account |

| Routing Number | Directing funds to the correct financial institution |

| Personal Information | Verifying identity to increase security |

| Login Credentials | Accessing and linking accounts on intermediary platforms |

By understanding how Netspend and Cash App work together, customers can better manage their money. They leverage the benefits of both prepaid cards and app-based financial services effectively.

Setting the Stage for a Transfer: Preparing Your Accounts

Starting to move money from Netspend to Cash App needs a good setup of both accounts. Making sure your prepaid card is activated is key for Netspend users to start transferring money. Besides allowing access to your funds, activation helps check that all your personal details are correct and safe. This careful checking is crucial to follow rules and keep you safe from money scams.

After activating the card, the next step is loading money onto it. This ensures you have enough money to transfer. The direct deposit option is handy for quickly adding earnings to Netspend, making it easier to send money to Cash App. This feature not only helps your money move smoothly but also makes managing your finances more flexible.

To set up on Cash App, you start by downloading the app and signing up. You’ll need to link financial information like bank accounts or debit cards. Like with Netspend, confirming and updating your personal info helps protect your financial standing. Paying close attention during these initial steps makes future transactions trouble-free.

| Preparation Step | Netspend | Cash App |

|---|---|---|

| Account Registration | Includes personal information submission & prepaid card order | App download followed by sign-up with personal details |

| Personal Information Verification | Required for identity confirmation & security | Essential for account validity and safety |

| Card Activation & Loading | Activation of prepaid card followed by fund loading | N/A – Card linking directly through the app |

| Fund Management Options | Direct deposit and additional reloading methods | Direct linking to bank accounts or debit cards |

Getting ready for transfers between Netspend and Cash App is about more than just moving money. It’s about creating a strong financial system. With proper account setup, including careful personal information verification and prepaid card activation, plus good money loading practices, you’re building a solid foundation. This prepares you for efficient money management and transfer capabilities.

How to Send Money from Netspend to Cash App Indirectly

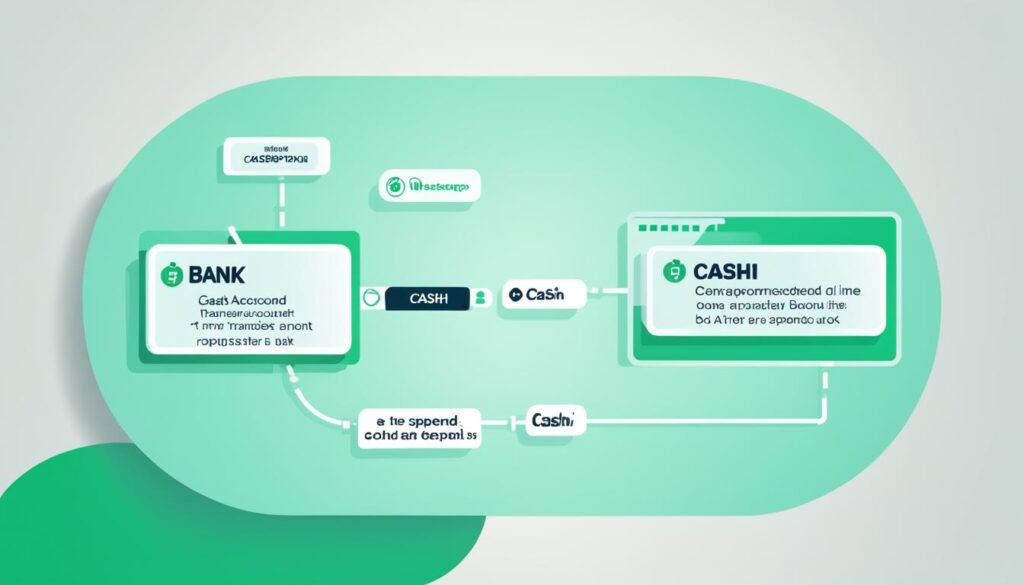

Digital finance is always changing, giving us new ways to handle our money. If you need to move money from Netspend to Cash App, you’ll use PayPal as a middleman. It’s key to know how to link your accounts properly. Doing so ensures a smooth transfer between these platforms.

Step-by-Step: Initiating the Transfer via PayPal

First, make sure your PayPal, your go-between, is set up and ready. It’s important that your PayPal account is active for linking.

Linking Netspend to Your PayPal Account

Linking accounts is easy. Just go to your PayPal and hit the ‘Wallet’ tab. Next, add your Netspend info under ‘Link a Card or Bank.’ Make sure you choose Netspend as your bank and enter everything correctly for a hassle-free link.

Adding Your PayPal Account to Cash App

Once you’ve linked Netspend to PayPal, add Cash App into the mix. Open Cash App, hit the ‘Banking’ tab, and select ‘Link Bank’ to enter your PayPal info. This step gets you closer to finishing your indirect transfer.

Completing the Transfer from Netspend to Cash App

Finally, you start the transfer from Netspend to PayPal and then onto Cash App. It’s very important to confirm each step. This includes linking the accounts and confirming the transfer itself.

| Procedure | Platform | Description |

|---|---|---|

| Account Linking | PayPal & Netspend | Add and verify Netspend account within PayPal |

| Account Linking | Cash App & PayPal | Connect PayPal to Cash App to facilitate transfers |

| Money Transfer | Netspend to PayPal | Initiate transfer and await confirmation |

| Money Transfer | PayPal to Cash App | Finalize the transfer by moving funds to Cash App |

Analyzing the Costs: Fees and Limits for Transfers

Managing money well means knowing about different costs in transferring funds. When moving money between Netspend and Cash App, users face transfer fees and bank transfer costs. Knowing these fees helps save money and make the most of financial tools.

Online transfers with Netspend usually have no extra charge, making it easy to manage money. But, getting help from Netspend Customer Service costs $4.95 per transaction. These costs add up in financial transactions and should be considered carefully.

Knowing transaction limits is key for users. Limits affect how much you can transfer, shaping your strategy. Staying within these limits avoids transfer failures and unexpected costs.

Here’s a simple overview of some usual charges and limits:

| Service Type | Fee | Daily Limit | Monthly Limit |

|---|---|---|---|

| Netspend Online Transfer | $0.00 | Varies | Varies |

| Customer Service Assisted Transfer | $4.95 | Varies | Varies |

| Bank/Credit Card Top-Up Fee | May Apply | N/A | N/A |

For cost-effective transfers, check Netspend’s and Cash App’s fees and limits. Reading the fine print could help save money and prevent extra charges. This is key to smart financial management.

In conclusion, dealing with transfer fees, bank transfer costs, and transaction limits can seem tough. Yet, resources like Netspend Customer Service help clear up confusion. By knowing these financial rules, users can handle their money well and avoid high expenses.

Transferring funds between Netspend and Cash App can sometimes be tricky. Knowing why problems occur and how to fix them makes for smoother transactions. First, make sure you have enough money and that your accounts are okay.

Common Reasons for Transfer Failures

Several factors could cause a transfer failure. Being aware can help avoid many issues:

- Not enough money in the Netspend account

- Wrong or old Netspend card info

- Issues with account verification

- Trying to transfer more than allowed

Resolving Transfer Complications

If a transfer failure happens, here’s what you can do:

- Check and correct your Netspend card details.

- Make sure both Netspend and Cash App accounts are verified.

- Keep your transfer amount within the limits, mindful of insufficient funds.

- Update both Netspend and Cash App apps if needed.

Customer Support Options for Netspend and Cash App

If problems keep up, or if you’re stuck, calling customer support is a smart move.

| Issue | Netspend Support | Cash App Support |

|---|---|---|

| Insufficient Funds Notice | Check your account, add money | Check transfer details again |

| Account Verification Needed | Finish the verification steps | Verify your identity using the app |

| Transfer Limit Exceeded | Get help adjusting limits | Learn about higher limit options |

| Technical Issues | Tips for software updates | Help with the app’s features |

Keeping your information clear, current, and verified is key to success. Being well-prepared and knowing who to contact for help makes managing money with Netspend and Cash App easy and efficient.

Managing Your Money Wisely: Tips and Best Practices

Using online tools like Netspend and Cash App requires smart financial planning. This planning helps you grow your money while keeping costs low. It’s essential to keep a close eye on your account activities and plan your transactions wisely. Checking your transaction history often is important. It helps you be aware of your spending and catches any unexpected fees.

Avoiding fees means knowing what costs come with your account. Costs could be instant transfer fees or fees for using ATMs. By planning your money moves carefully, you can save more. This fits into your broader financial plan for better savings.

Good money management means being proactive. Get into the habit of regularly looking at your balance and upcoming transactions. Double-checking your accounts prevents problems. This helps avoid unnecessary fees or delays on transfers. By managing your money this way, you’re on track for a financially secure future.

- Schedule transfers strategically to avoid overdraft or excess transaction fees

- Ensure your personal information is up-to-date for seamless account operations

- Understand the terms and conditions of both Netspend and Cash App to manage your daily and monthly transfer limits

- Monitor your accounts regularly for any changes in fees or policies

- Utilize automated alerts for account balance thresholds to keep your spending in check

Conclusion

Transferring money from Netspend to Cash App shows the power of online banking. It lets people move their money easily and safely. By understanding how these digital payment systems work, users can better manage their funds. This knowledge helps them use their money more wisely.

The transfer method might not be direct, but it’s safe and gives users control. Learning about the fees and limits helps people avoid stress. For those who know their way around technology, transferring money this way is not just easy. It’s also a sign of how modern banking gives us more freedom.

Using tools like Netspend and Cash App smartly is important. They help with everyday spending and saving for the future. Knowing how to use these tools helps users make the most of digital banking. This way, transferring money becomes easy and powerful, showing what today’s tech can do.

FAQ

Can I directly transfer funds from Netspend to Cash App?

No, you can’t transfer money directly from Netspend to Cash App. But you can do it through PayPal first.

What is Netspend and how does it work with Cash App?

Netspend offers reloadable prepaid cards for those without bank accounts. It doesn’t link directly with Cash App. But, using PayPal, you can transfer money to Cash App.

How do I prepare my Netspend and Cash App accounts for a money transfer?

Make sure both your Netspend and Cash App accounts are active. Your Netspend card should be activated with funds on it. Your Cash App must have a linked bank or debit card. Also, check that all your personal info is up to date.

What are the steps for transferring money from Netspend to Cash App through PayPal?

First, connect your Netspend to PayPal. Next, add PayPal to your Cash App. Move money from Netspend to PayPal. Then, transfer from PayPal to Cash App.

Are there any fees for transferring money from Netspend to Cash App?

Transferring money with Netspend online is free, but customer service transfers cost .95. Cash App and PayPal might have their own fees. Always check their fees first.

What could cause a transfer from Netspend to Cash App to fail?

A transfer might not work if you don’t have enough money, enter incorrect card details, or your accounts aren’t verified. Transfers can also fail if you try to send too much money. Always double-check your information and make sure everything is verified and funded.

How can I resolve issues during the transfer process between Netspend and Cash App?

If you have trouble, try entering your card info again, verify your accounts, don’t go over the limit, and keep your apps updated. If issues don’t clear up, get in touch with Netspend or Cash App support for help.

What are some tips for managing money effectively when using Netspend and Cash App?

Plan when you’ll transfer money to avoid going over limits. Keep an eye on fees and updates. Make sure your personal info is current on both platforms to keep transactions smooth.