I may earn a commission from affiliate partner links featured here on my site. Such commissions allow me to maintain and improve this site. Read full Disclosure.

Have you been asking the same question consumers asked on how does Klarna make money? With its innovative approach to online payments and flexible financing options, Klarna the popular buy-now-pay-later service has revolutionized the way consumers shop and pay for their purchases.

In this article, we’ll explore the intricate business model behind Klarna, uncovering the various revenue streams that fuel its operations and sustain its growth.

Contents

- 1 What Is Klarna?

- 2 A Short History of Klarna

- 3 Klarna’s Transition into a Fintech Company

- 4 Klarna’s Mission and Vision

- 5 How Does Klarna Work?

- 6 How Does Klarna Make Money?

- 7 Klarna’s AI Integrations

- 8 The Klarna Business Model Explained

- 9 Klarna’s Funding, Valuation & Revenue

- 10 What Products Does Klarna Offer?

- 11 Does Klarna Actually Make Money?

- 12 What is Klarna’s Net Worth?

- 13 Does Klarna Affect My Credit Score?

- 14 Why Consumers Use Klarna

- 15 Perspective of Business Owners about Klarna

- 16 Does Klarna Have a Downside?

- 17 Should You Avoid Klarna for Financial Peace of Mind?

- 18 Key Takeaways

- 19 Bottom Line

- 20 FAQ

- 20.1 Is Klarna legit?

- 20.2 How much does Klarna charge its merchants per transaction?

- 20.3 What happens if my Klarna repayment is late?

- 20.4 What is the highest limit you can get on Klarna?

- 20.5 What percentage do you pay with Klarna?

- 20.6 Can I borrow money from Klarna?

- 20.7 How many purchases can you make with Klarna at once?

- 20.8 How do you qualify for Klarna?

What Is Klarna?

Klarna is a Swedish fintech company that provides payment solutions and buy-now-pay-later services to consumers and merchants.

Founded in 2005, the company has experienced rapid growth, now operating in 17 countries and serving over 147 million consumers globally.

A Short History of Klarna

Klarna’s journey began in Stockholm, Sweden, where it was founded by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson.

Initially, the company focused on simplifying online payments for e-commerce businesses, aiming to reduce cart abandonment rates and streamline the checkout process.

Klarna’s Transition into a Fintech Company

Over time, Klarna expanded its services beyond online payments, introducing buy-now-pay-later (BNPL) options and other financial services.

This transition positioned Klarna as a fintech company, leveraging technology to offer innovative financial solutions to consumers and businesses alike.

Klarna’s Mission and Vision

Klarna’s mission is to make payments simple, safe, and smooth for both consumers and retailers. The company envisions a world where traditional credit cards and complicated payment methods are replaced by seamless and user-friendly alternatives.

How Does Klarna Work?

At its core, Klarna offers a buy-now-pay-later service that allows consumers to purchase products and pay for them in installments or at a later date. Customers can choose from various payment options, such as:

- Pay Later: Receive the goods first and pay for them within a specified period, typically 14 to 30 days.

- Installments: Split the cost into equal, interest-free installments over a set period, usually 3 to 36 months.

- Financing: For larger purchases, Klarna offers longer-term financing options with interest charges.

How Does Klarna Make Money?

Klarna operates a multifaceted business model, generating revenue through various channels. Here are the primary ways that tackled the question how does Klarna make money:

Merchant Fees

Klarna charges merchants a fee for facilitating transactions and providing buy-now-pay-later services to customers. These fees typically range from 3% to 6% of the total purchase amount and can vary depending on factors such as the merchant’s industry, transaction volume, and risk profile.

Interest Income

For longer-term financing options or when customers opt to pay in installments, Klarna earns interest income on the outstanding balances. The interest rates may vary based on factors like the consumer’s creditworthiness and the loan duration.

Late Fees and Penalties

If customers fail to make their payments on time, Klarna may charge late fees or penalties. These fees can vary depending on the country and specific regulations.

Advertising

Klarna generates revenue by displaying targeted advertisements within its app and website. Merchants and other businesses can advertise their products or services to Klarna’s user base.

Cross-Selling

Klarna offers additional financial products and services, such as virtual cards, savings accounts, and investment opportunities. By cross-selling these products to its existing customer base, Klarna generates additional revenue streams.

Licensing Fees

Klarna licenses its payment technology and services to other companies, generating revenue through licensing fees and royalties.

Partnerships and Collaborations

Klarna has formed strategic partnerships with various retailers, banks, and other financial institutions. These collaborations can involve revenue-sharing agreements, referral fees, or other financial arrangements.

Klarna’s AI Integrations

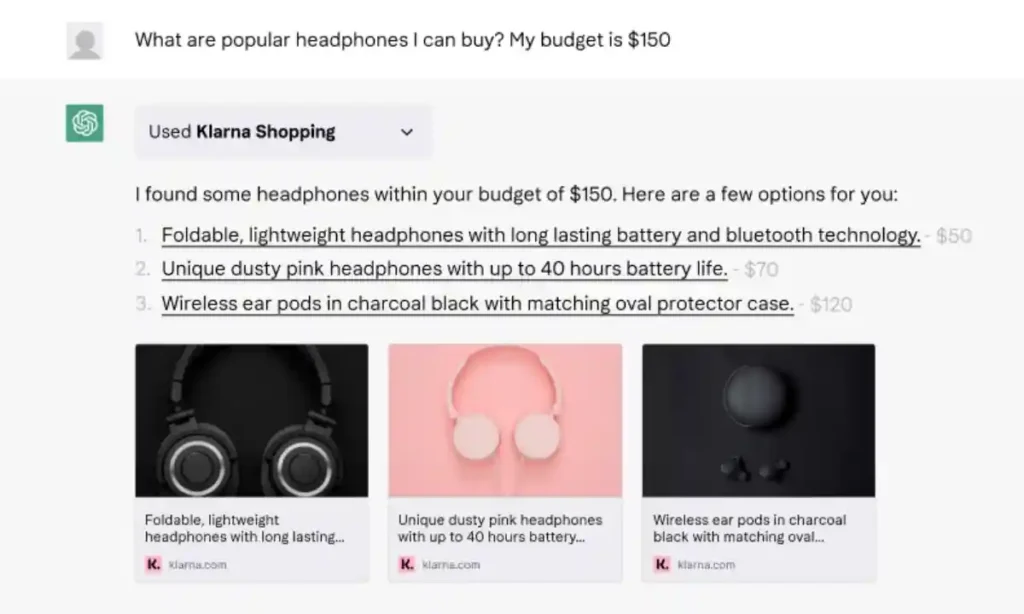

ChatGPT Integration

In a recent development, Klarna has integrated ChatGPT, an advanced language model developed by OpenAI, into its platform. This integration aims to enhance the customer experience by providing personalized assistance and recommendations.

How Klarna’s ChatGPT Plugin Works

Klarna’s ChatGPT plugin allows customers to interact with the AI assistant through the Klarna app or website. Users can ask questions, get recommendations, and receive personalized support related to their purchases, payments, and account management.

Clarity AI Integration

In addition to ChatGPT, Klarna has also integrated Clarity AI, a platform that combines machine learning and natural language processing. This integration enables Klarna to better understand customer queries and provide more accurate and relevant responses.

The Klarna Business Model Explained

At its core, Klarna’s business model revolves around facilitating transactions between consumers and merchants while offering flexible payment options.

This innovative approach has disrupted the traditional payment industry, providing a win-win situation for both parties involved.

For consumers, Klarna offers a convenient and flexible way to make purchases. Instead of paying the full amount upfront or relying on traditional credit cards, Klarna allows customers to spread their payments over time or delay payment until a later date.

This flexibility can help alleviate financial strain and make larger purchases more accessible for those on a budget.

On the merchant side, partnering with Klarna provides several benefits. By offering Klarna’s buy-now-pay-later options at checkout, merchants can reduce cart abandonment rates and boost sales.

When customers have more flexible payment options, they are more likely to complete their purchases, leading to increased conversions and revenue for the merchant.

Furthermore, Klarna’s user base represents a potential pool of new customers for merchants. By integrating Klarna’s payment solutions, merchants can tap into this vast customer base, expanding their reach and attracting new customers who may have previously been deterred by the lack of flexible payment options.

Klarna also assumes the risk of non-payment, protecting merchants from potential losses due to customers defaulting on their payments.

This risk mitigation can provide peace of mind for merchants, allowing them to focus on their core business operations while Klarna handles the payment processing and collections.

By providing a seamless and user-friendly payment experience, Klarna aims to increase customer loyalty and encourage repeat purchases.

Customers who have a positive experience with Klarna’s services are more likely to continue using the platform for future purchases, fostering long-term relationships between consumers and merchants.

Moreover, Klarna’s partnerships and collaborations with various retailers, banks, and financial institutions further solidify its position in the market.

These strategic alliances can involve revenue-sharing agreements, referral fees, or other financial arrangements, creating additional revenue streams for Klarna and strengthening its overall business model.

Klarna’s business model is a prime example of how innovation and technology can disrupt traditional industries.

By leveraging the power of flexible payment options and strategic partnerships, Klarna has created a win-win situation for consumers and merchants, paving the way for a more convenient and user-friendly payment ecosystem.

Klarna’s Funding, Valuation & Revenue

To support its growth and expansion, Klarna has raised significant funding from various investors. As of its latest funding round in 2022, Klarna’s valuation stood at around $6.7 billion.

While the company’s revenue figures are not publicly disclosed, industry experts estimate that Klarna generated over $1 billion in revenue in 2021.

What Products Does Klarna Offer?

In addition to its core buy-now-pay-later services, Klarna offers a range of products and services, including:

- Klarna Card: A physical and virtual card that allows customers to pay with Klarna at any retailer that accepts Visa.

- Klarna App: A mobile application where customers can manage their purchases, payments, and account settings.

- Klarna Rewards: A loyalty program that rewards customers with points for using Klarna and making timely payments.

- Klarna Shopping: A browser extension and app that allows customers to easily use Klarna at various online retailers.

Does Klarna Actually Make Money?

While Klarna’s innovative business model has disrupted the traditional payment industry, the company’s profitability has been a subject of debate.

Despite its rapid growth and popularity, Klarna has faced challenges in achieving consistent profitability.

In the first part of 2021, Klarna reported a loss of 1.8 billion Swedish krona due to pre-tax loss soared more than threefold year-on-year to nearly 6.2 billion krona and partly due to increased marketing and expansion efforts, as well as the impact of the COVID-19 pandemic on consumer spending.

However, the company remains optimistic about its long-term prospects and continues to focus on expanding its product offerings and geographical reach.

What is Klarna’s Net Worth?

As a private company, Klarna’s net worth is not publicly disclosed. However, based on its latest funding round and valuation of $6.7 billion, it is reasonable to assume that Klarna’s net worth is substantial, reflecting its market position and growth potential.

Does Klarna Affect My Credit Score?

One of the key concerns for many consumers when using buy-now-pay-later services like Klarna is the potential impact on their credit scores. It’s important to understand how Klarna’s services interact with your credit history and credit score.

In most cases, using Klarna’s buy-now-pay-later services does not directly impact your credit score.

Klarna does not report your payment history or account activity to major credit bureaus like Experian, Equifax, and TransUnion.

This means that making on-time payments or using Klarna responsibly will not necessarily improve your credit score.

However, there are instances where Klarna can indirectly affect your credit score:

- Late or Missed Payments: If you consistently miss or make late payments on your Klarna account, the company may report this delinquent behavior to credit bureaus. Negative payment history can have a detrimental effect on your credit score, as it indicates a higher risk of defaulting on future credit obligations.

- Debt Collection: In cases where you fail to make payments and your account goes into collections, Klarna may sell the debt to a third-party collection agency. These collection accounts can appear on your credit report and significantly impact your credit score.

- Credit Utilization: While Klarna does not directly report your account activity to credit bureaus, some credit scoring models may consider the outstanding balances you have with buy-now-pay-later services like Klarna. High outstanding balances can increase your credit utilization ratio, which can negatively impact your credit score.

It’s important to note that while Klarna may not directly affect your credit score in most cases, other lenders and financial institutions may still consider your Klarna payment history and account activity when assessing your creditworthiness.

Responsible use of Klarna’s services can demonstrate your ability to manage credit obligations, which can be beneficial when applying for other forms of credit, such as loans or credit cards.

To maintain a positive credit score and avoid any negative impact from using Klarna, it’s essential to make your payments on time and manage your overall debt responsibly.

Additionally, monitoring your credit report regularly can help you identify any potential issues and take corrective action if necessary.

Why Consumers Use Klarna

Consumers are attracted to Klarna for several reasons:

- Flexible Payment Options: Klarna offers various payment plans, allowing customers to pay for purchases over time or at a later date.

- Interest-Free Financing: For shorter-term installment plans, Klarna often provides interest-free financing, making it an attractive option for budget-conscious consumers.

- Easy Integration: Klarna is integrated with many online retailers, making it a convenient payment option during the checkout process.

- User-Friendly Experience: Klarna’s user interface and mobile app are designed to be user-friendly, providing a seamless payment and account management experience.

Perspective of Business Owners about Klarna

For businesses and merchants, partnering with Klarna can provide several benefits:

- Increased Sales: By offering flexible payment options, Klarna can help reduce cart abandonment rates and boost sales for merchants.

- Customer Acquisition: Klarna’s user base represents a potential pool of new customers for merchants, expanding their reach and customer base.

- Risk Mitigation: Klarna assumes the risk of non-payment, protecting merchants from potential losses.

- Streamlined Checkout: Integrating Klarna’s payment solutions can simplify the checkout process, improving the overall customer experience.

Does Klarna Have a Downside?

While Klarna offers convenience and flexibility, it’s important to be aware of potential downsides and risks associated with its use:

Debt Accumulation

The ease of accessing credit and spreading payments over time can lead to accumulating debt if not managed responsibly.

Interest Charges

While Klarna offers interest-free options for shorter-term installments, longer-term financing options may incur interest charges, potentially increasing the overall cost of purchases.

Impulsive Buying Behavior

The availability of buy-now-pay-later options can encourage impulsive buying behavior, leading to overspending and financial strain.

Potential Impact on Credit Score

While Klarna does not directly impact credit scores, missed or late payments may be reported to credit bureaus, potentially affecting your credit history.

Limited Acceptance

Klarna is not universally accepted by all merchants, which can limit its usefulness in certain situations.

Temptation to Overspend

The ability to spread payments over time can create a false sense of affordability, leading to overspending beyond one’s means.

Should You Avoid Klarna for Financial Peace of Mind?

The decision to use Klarna or any buy-now-pay-later service ultimately comes down to your personal financial situation, spending habits, and money management skills.

While Klarna can offer convenience and flexibility, it’s crucial to be aware of the potential risks and downsides associated with its use.

If you have a history of overspending, struggle with managing debt, or find it challenging to stick to a budget, it may be wise to avoid buy-now-pay-later services like Klarna.

The ease of accessing credit and spreading payments over time can lead to accumulating significant debt if not approached responsibly.

Additionally, the temptation to make impulsive purchases can be heightened, leading to financial strain and compromising your overall financial well-being.

However, for financially responsible individuals who have a firm grasp on their spending habits and can consistently make timely payments, Klarna can offer convenience and flexibility without compromising financial peace of mind.

By adhering to a budget, avoiding impulse purchases, and ensuring that you have sufficient funds to cover your installments, you can leverage Klarna’s services while maintaining control over your finances.

It’s important to remember that while Klarna’s buy-now-pay-later options can make larger purchases seem more affordable in the short term, they do not eliminate the overall cost.

Interest charges may apply for longer-term financing options, potentially increasing the total cost of your purchases. Additionally, missed or late payments can result in fees and penalties, further compounding your financial obligations.

To ensure that Klarna does not become a source of financial stress, it’s essential to approach it with discipline and a clear understanding of your financial capabilities.

Set realistic budgets, track your expenses, and prioritize paying off your Klarna installments on time to avoid accumulating debt and damaging your credit score.

Ultimately, the decision to use Klarna should be based on a careful assessment of your financial situation, spending habits, and ability to manage credit responsibly.

If you have any doubts or concerns about your ability to use Klarna prudently, it may be best to err on the side of caution and explore alternative payment methods that align better with your financial goals and peace of mind.

Key Takeaways

- Klarna generates revenue through various channels, including merchant fees, interest income, late fees, advertising, cross-selling, licensing, and partnerships.

- The company’s business model revolves around facilitating transactions between consumers and merchants while offering flexible payment options.

- Klarna has expanded its product offerings and integrated advanced AI technologies like ChatGPT and Clarity AI to enhance the customer experience.

- While Klarna has faced profitability challenges, it continues to grow and attract significant funding, reflecting its market potential.

- Consumers are attracted to Klarna for its flexible payment options, interest-free financing, and user-friendly experience.

- Merchants benefit from increased sales, customer acquisition, risk mitigation, and streamlined checkout processes by partnering with Klarna.

- Responsible use of Klarna’s services can provide convenience and flexibility, but it’s essential to be aware of potential risks, such as debt accumulation, interest charges, and the temptation to overspend.

Bottom Line

Klarna’s innovative business model and buy-now-pay-later services have disrupted the traditional payment industry, offering consumers a flexible and convenient way to make purchases.

By leveraging technology and strategic partnerships, Klarna has diversified its revenue streams and expanded its product offerings.

While the company has faced profitability challenges, its continued growth and substantial funding reflect its market potential and the growing demand for alternative payment solutions.

We hoped this has answered your question on how does Klarna make money? Share your thoughts about this in the comment section below!

FAQ

Is Klarna legit?

Yes, Klarna is a legitimate and well-established fintech company operating in 17 countries and serving over 147 million consumers globally. It is regulated by financial authorities in the countries where it operates.

How much does Klarna charge its merchants per transaction?

Klarna typically charges merchants a fee ranging from 3% to 6% of the total purchase amount for facilitating transactions and providing buy-now-pay-later services.

What happens if my Klarna repayment is late?

If you miss a Klarna payment, you may be charged late fees or penalties, and your account may be restricted or suspended. Repeated late payments can also negatively impact your credit score.

What is the highest limit you can get on Klarna?

Klarna’s spending limits vary based on individual factors such as creditworthiness, purchase history, and risk assessment. The limits are not publicly disclosed but can increase or decrease over time based on your usage and payment behavior.

What percentage do you pay with Klarna?

When using Klarna’s “Pay Later” option, you typically pay the full amount within a specified period (e.g., 14 to 30 days). For installment plans, you pay a percentage of the total amount upfront, followed by equal installments over a set period.

Can I borrow money from Klarna?

No, Klarna does not offer direct borrowing or lending services. Its services are focused on facilitating purchases and offering flexible payment options for those purchases.

How many purchases can you make with Klarna at once?

Klarna does not impose a specific limit on the number of purchases you can make at once. However, your spending limit and approval for new purchases will depend on factors such as your payment history, creditworthiness, and risk assessment.

How do you qualify for Klarna?

To qualify for Klarna, you typically need to provide personal information such as your name, email address, and billing address. Klarna may also perform a soft credit check to assess your creditworthiness and determine your spending limit.